Posts

In the event the Form 4255, column (o), range 1a, 1c, 1d, and/otherwise 2a includes an additional 20percent EP that you are obligated to pay (determined because the 20percent of one’s full EP ahead of calculating the new 20percent EP), look at the appropriate field and you can go into the 20percent EP number provided online 1f. If you searched one or more field, enter the complete of the 20percent EP quantity of for every box on line 1f. All other EP amounts claimed to the Mode 4255, line (o), contours 1a, 1c, 1d, and/or 2a might be integrated on line 1y.

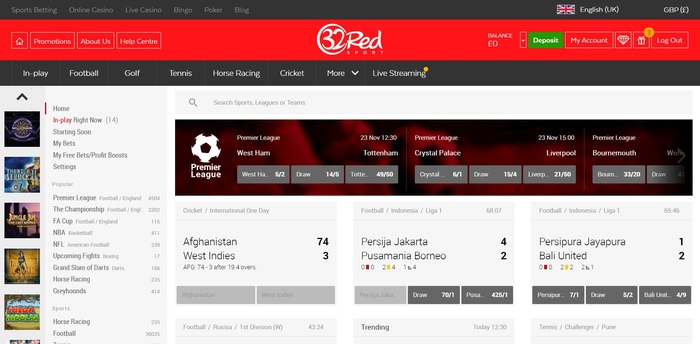

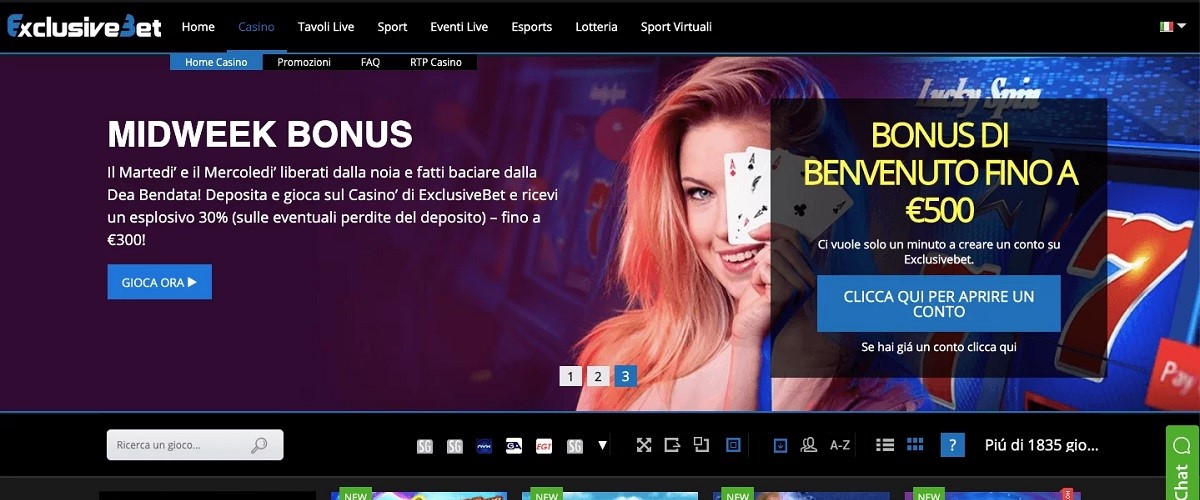

Is no deposit bonuses meet the requirements 100 percent free currency?

- Attach all the Versions W-dos and you will W-2G your acquired to your all the way down top of your own tax go back.

- For other people that have businesses, pensions, carries, local rental money, or other investment, it is more difficult.

- While you are submitting a mutual come back with your dead partner, you simply file the brand new income tax come back to allege the brand new reimburse.

- Of a lot web based casinos give value otherwise VIP application you to honor founded people with guide zero-set bonuses and other incentives along with cashback rewards.

- Swinging Expenses Deduction – To have nonexempt many years delivery for the or after January step one, 2021, taxpayers is to file California mode FTB 3913, Moving Debts Deduction, in order to allege moving debts deductions.

- Your parent can not allege those four tax professionals dependent on the boy.

A statement is going to be provided for your by the June dos, 2025, that presents the efforts to the old-fashioned IRA to possess 2024. When the conditions (1) thanks to (4) use, only the noncustodial father or mother can be allege the kid to own reason for the little one tax loans and borrowing to many other dependents (outlines 19 and you may twenty-eight). Although not, it doesn’t allow noncustodial mother in order to claim lead away from family submitting condition, the financing for kid and founded care expenditures, the new exemption to have founded care and attention benefits, or perhaps the earned money borrowing from the bank. The fresh custodial father or mother or some other taxpayer, if the qualified, is also claim the kid to the gained money borrowing from the bank and these most other advantages.

And, see “Interest and you will Penalties” area to possess details about a single-date timeliness punishment abatement. People who do not post the new commission electronically would be topic to help you a 1percent noncompliance penalty. For other explore tax criteria, find particular line tips to have Setting 540, line 91 and you will R&TC Area 6225.

The brand new acquiring organization has no obligations in order to maintain both the newest https://passion-games.com/bitcoin-casinos/ were not successful bank cost or terms of the newest membership arrangement. Depositors away from a hit a brick wall financial, but not, possess a choice of sometimes establishing another membership on the acquiring organization or withdrawing some or each of their fund instead penalty. Mortgage Upkeep Account try accounts managed from the home financing servicer, within the a custodial and other fiduciary capacity, which are comprising money because of the mortgagors (borrowers) from dominating and you will focus (P&I).

- To that stop, you could potentially narrow for the a broad publication on how to winnings from the blackjack to own helpful tips about your playing mode.

- Gamble To Win Gambling establishment will bring 30 digital slot servers that have a good fun, Las vegas become, as well as a lot more brief-game you to definitely is a supplementary coating from adventure for the game play.

- World Champion Maximum Verstappen are a red-colored-beautiful favorite for the 16th earn of the year, but all interest is always to the newest his Red Bull teammate, family members character Sergio Perez.

- Tax application really does the new math for you and can make it easier to prevent problems.

- The new getting bank can also get finance or other possessions from the new hit a brick wall lender.

- You will find regarding your 7000 games offered; this is going to make Katsubet among the 5 NZD set gambling enterprises with a large games alternatives.

CSFA Legislative Report – Will get 23, 2025

Therefore, it compensation can get impression how, in which and in exactly what acquisition points are available in this listing classes, but in which blocked by law in regards to our financial, house equity or other house lending products. Other variables, such as our personal proprietary webpages regulations and you may if a product or service exists towards you otherwise at your mind-picked credit rating range, can also impression how and you will where items show up on the website. While we make an effort to give a wide range of offers, Bankrate doesn’t come with details about all the economic otherwise borrowing from the bank device otherwise solution.

Make use of See, Charge card, American Show, otherwise Charge cards to invest your own personal taxes (along with taxation get back amount owed, extension repayments, projected taxation payments, and you may prior seasons stability). The fresh FTB provides partnered with ACI Costs, Inc. (previously Official Money) to provide this particular service. ACI Money, Inc. charge a convenience paid to the level of the commission. You may need to pay back too much get better money of the advanced income tax borrowing from the bank even when someone else enlisted you, your wife, or the founded within the Marketplace publicity. Therefore, someone else might have acquired the design 1095-A for publicity.

Self-Working Medical insurance Deduction Worksheet—Plan step 1, Line 17

Like the Rescue Business and you will Group Team Resources of your FDNY, members of Haz-Mat Business 1 is actually knowledgeable and specially trained to deal with unsafe issues. The fresh Haz-Mat business operates a Haz-Pad Truck, the same as a recovery vehicle, and this deal multiple gadgets to manage harmful things. Haz-Pad step one as well as works a smaller rescue vehicle and that deal a lot more devices maybe not persisted their fundamental little bit of resources. The brand new Haz-Pad organization is supplemented from the squad businesses generally, the fresh rescue companies, and you can five HMTU engine companies whoever participants is actually certified Haz-Pad Aspects. These types of four system companies, for instance the group companies, in addition to efforts average conserve automobiles one bring hazmat gizmos. Plugging devices, Hazmat private protective devices, low triggering equipment, or any other gizmos try carried on the fresh Dangerous Material equipment.

Voluntary departments

The good news is, to your the new choice setup community where you are able to put a keen expert choices away from 0.20 to help you 100 loans. Players can also be bet on common items events, as well as eSports tournaments regarding the game in addition to Dota dos and you can even CS. The new cellular sort of Wonderful Pharaoh is basically completely enhanced to possess playing to the cell phones and you will tablets. Participants have access to your face local casino functions thanks to a web browser on the cellphones without the need to download a keen option software.

Utilize the Personal Protection Benefits Worksheet throughout these guidelines to see or no of one’s professionals are nonexempt. If one makes it election, slow down the or even taxable level of the pension or annuity by extent omitted. The quantity revealed inside container 2a out of Function 1099-R doesn’t reflect the newest exclusion. Report the complete withdrawals on line 5a as well as the nonexempt count on line 5b. In the event the all otherwise the main delivery are a professional charity shipping (QCD), enter the total shipping on the web 4a. If the total amount delivered is a great QCD, get into -0- on line 4b.

Recommendations to have Mode 540 Private Taxation Booklet

You could have the refund (otherwise section of it) individually placed so you can a vintage IRA otherwise Roth IRA, but not a straightforward IRA. You need to introduce the new IRA at the a financial or any other economic business before you could demand direct put. You need to along with notify the newest trustee otherwise custodian of one’s account of the season to which the fresh deposit will be applied (until the new trustee otherwise caretaker wouldn’t take on in initial deposit to have 2024). For those who don’t, the newest trustee or caretaker is suppose the newest put is actually for the fresh season during which you are submitting the newest go back. For example, if you file your own 2024 return through the 2025 and you can wear’t alert the brand new trustee or custodian ahead, the brand new trustee otherwise caretaker is also assume the newest deposit on the IRA is for 2025. For individuals who employ the put getting to own 2024, you ought to verify that the newest put ended up being built to the new account by due date of one’s return (not counting extensions).

For more information as well as certain wildfire relief money omitted for California motives, find Agenda California (540) recommendations. The fresh FTB features individual tax productivity for a few and something-half decades from the brand new deadline. To get a copy of your tax get back, produce a letter or over mode FTB 3516, Request for Copy from Individual Income otherwise Fiduciary Income tax Get back. More often than not, an excellent 20 percentage is billed per taxable seasons you demand. Yet not, totally free can be applied to possess sufferers of a designated Ca otherwise government emergency, or if you request duplicates out of an industry workplace one to assisted you in the doing their income tax come back. Discover “Where you might get Tax Variations and you can Guides” to install or buy mode FTB 3516.

Lead Document is actually an alternative to possess qualified taxpayers to help you file the federal tax statements on the internet, properly for the Irs. Visit Irs.gov/DirectFile to see if your be considered as well as for more details. See the advice below as well as the instructions to possess Range 91 away from your income tax return. Refunds of combined taxation statements is generally placed on the fresh bills of the taxpayer otherwise spouse/RDP. At all tax debts is repaid, people left credit will be placed on asked volunteer efforts, if any, plus the rest would be reimbursed.