Local Payment Gateways in Bangladesh

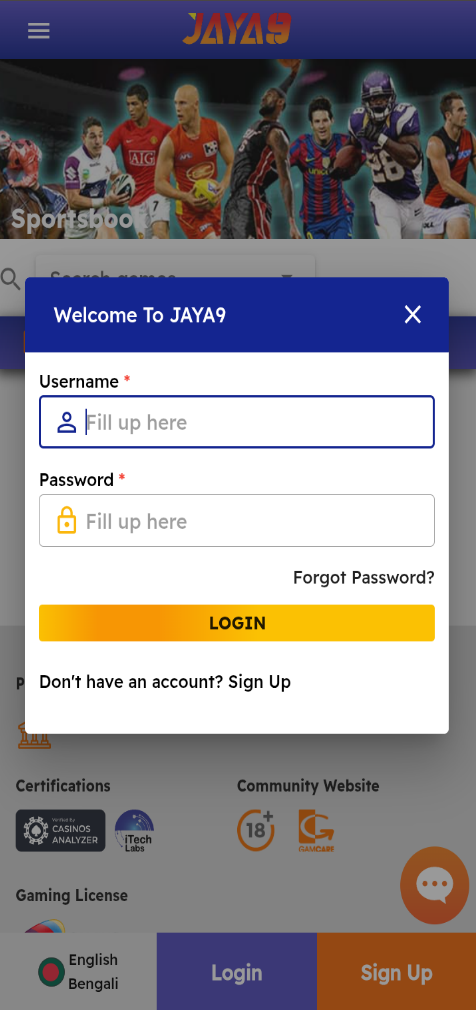

In recent years, Bangladesh has witnessed a rapid transformation in its digital payment landscape. The advent of Local Payment Gateways in Bangladesh Casinos jaya9 app and various local payment gateways has revolutionized the way individuals and businesses conduct transactions. This article delves into the importance of local payment gateways in Bangladesh, exploring their features, advantages, and impact on the economy.

The Rise of Digital Payments in Bangladesh

With a population exceeding 160 million and a significant portion actively engaging in online activities, Bangladesh has become a fertile ground for e-commerce growth. The traditional cash-based economy is gradually shifting towards digital payments, driven by factors such as increasing internet penetration, smartphone usage, and the government’s push for a cashless society.

The Covid-19 pandemic accelerated this shift, compelling consumers to adopt online payment methods for safety and convenience. As a result, local payment gateways have emerged as essential players in facilitating seamless transactions for both consumers and merchants.

Understanding Local Payment Gateways

Local payment gateways are platforms that allow businesses and individuals to process online payments securely and efficiently. They are specifically designed to cater to the needs of local markets, offering features and services that resonate with Bangladeshi users. Some of the key characteristics include:

- Local Currency Support: Local payment gateways support transactions in Bangladeshi Taka (BDT), ensuring that users do not incur unnecessary conversion fees.

- Payment Methods Variety: These gateways often support a variety of payment methods, including credit and debit cards, mobile banking, and cash on delivery.

- User-Friendly Interfaces: They offer intuitive interfaces that enhance user experience, encouraging more people to engage in online shopping and payments.

Advantages of Local Payment Gateways

Local payment gateways provide several advantages that contribute to their growing popularity in Bangladesh:

- Security: Most local gateways employ advanced security measures such as encryption and tokenization to protect users’ sensitive information and prevent fraud.

- Faster Transactions: Local gateways facilitate quicker transaction processing compared to international alternatives, leading to improved customer satisfaction.

- Better Customer Support: Local providers often have dedicated customer service teams that cater to the specific needs of Bangladeshi users, ensuring quick resolutions to any issues that arise.

Popular Local Payment Gateways in Bangladesh

The landscape of local payment gateways in Bangladesh is diverse, with several players making a significant impact:

- Bkash: As one of the leading mobile financial service providers, Bkash has a massive user base and offers a wide range of services, including person-to-person transfers, bill payments, and merchant payments.

- Rocket: Operated by Dutch-Bangla Bank, Rocket is another popular mobile banking service that allows users to send and receive money easily and pay bills.

- Nagad: A relatively newer player, Nagad has rapidly gained traction due to its user-friendly interface and competitive fees.

- PayPal (via local partners): While PayPal is not directly available in Bangladesh, some local partners offer services that allow users to transact using PayPal accounts.

The Regulatory Framework

The Bangladesh government, through the Bangladesh Bank, has established a regulatory framework to oversee the operation of payment gateways. This framework is crucial in ensuring that the services offered are secure, fair, and accessible to all, while also promoting competition among service providers.

The government has encouraged the adoption of digital payments as a means to enhance financial inclusion and drive economic growth. By fostering a supportive regulatory environment, local payment gateways can thrive and continue to innovate, providing better services to the population.

The Future of Payment Gateways in Bangladesh

Looking ahead, the future of local payment gateways in Bangladesh appears promising. With continuous advancements in technology, we can expect to see the following trends:

- Integration with E-Commerce: As e-commerce expands, local payment gateways will integrate more seamlessly with online shopping platforms, providing enhanced user experiences.

- Blockchain Technology: The potential use of blockchain technology in payment gateways could enhance security and transparency, making transactions even more reliable.

- AI and Data Analytics: Leveraging AI and data analytics will enable payment gateways to personalize services and detect fraudulent activities more effectively.

Conclusion

Local payment gateways are playing a pivotal role in shaping the financial landscape of Bangladesh. By providing secure, efficient, and user-friendly solutions, they are empowering consumers and businesses alike to engage in digital transactions. As the country continues to embrace digitalization, the importance of robust local payment systems will only grow, further driving economic development and financial inclusion for all.