In the world of cryptocurrency trading, leverage plays a crucial role in maximizing potential returns. One platform that has gained significant attention in this space is PrimeXBT. This article provides an in-depth look at how to primexbt change leverage PrimeXBT funding and effectively manage leverage to optimize your trading outcomes. Whether you’re a novice or an experienced trader, understanding how to change leverage according to market conditions and personal risk tolerance can greatly influence your success.

What is Leverage in Trading?

Leverage in trading refers to the practice of using borrowed capital to increase the potential return on an investment. In the context of cryptocurrency trading, leverage allows traders to open positions that are significantly larger than their actual capital. For example, if a trader uses 10x leverage, they can control a position worth $10,000 with just $1,000 of their own funds.

Understanding PrimeXBT’s Leverage System

PrimeXBT offers a flexible leverage system that allows traders to adjust their leverage settings based on their trading strategy and risk appetite. The platform provides leverage options ranging from 1x to 100x, depending on the trading pair. This versatility is beneficial for both conservative traders who prefer lower risk and aggressive traders looking to amplify their gains.

Why Change Leverage?

Changing leverage is essential for several reasons:

- Risk Management: By adjusting leverage, traders can manage their exposure to the market effectively. Lowering leverage can help mitigate potential losses in volatile market conditions.

- Market Conditions: Different market scenarios demand different approaches. During high volatility, traders might opt for lower leverage, while in stable conditions, higher leverage can be pursued.

- Personal Strategy: Each trader has a unique risk tolerance and strategy. Changing leverage allows traders to align their trading approach with their individual investment philosophy.

How to Change Leverage on PrimeXBT

Changing leverage on PrimeXBT is a straightforward process. Here’s a step-by-step guide to help you navigate through it:

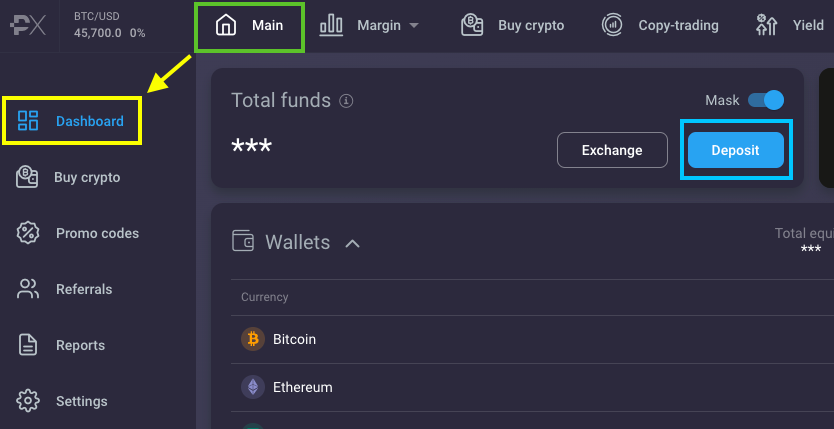

Step 1: Log into Your Account

Begin by logging into your PrimeXBT trading account. Ensure you have completed the necessary verification process before trading.

Step 2: Select Your Trading Pair

Navigating to the trading interface, select the cryptocurrency pair you wish to trade. The leverage options available will depend on the selected pair.

Step 3: Adjust Leverage Settings

Once you have selected your trading pair, look for the leverage settings on the trading interface. Here, you can adjust the leverage slider to your desired level. Keep in mind the maximum leverage allowed for the chosen pair.

Step 4: Confirm Your Leverage Change

After setting your preferred leverage, confirm the changes before placing your trade. It’s important to double-check your leverage settings, as this will directly impact your position size and risk exposure.

Strategies for Using Leverage Effectively

While leverage can amplify profits, it also increases the risk of losses. Here are some strategies to use leverage effectively:

1. Start Small

If you are new to trading with leverage, it’s advisable to start with lower leverage. This approach allows you to gain experience without exposing yourself to high levels of risk.

2. Use Stop-Loss Orders

Implementing stop-loss orders is a crucial part of risk management. By setting stop-loss levels, you can automatically close your positions when the market moves against you, helping to protect your capital.

3. Monitor Market Conditions

Stay informed about market trends and news that may impact the cryptocurrencies you are trading. Being aware of market conditions can help you decide when to adjust leverage accordingly.

4. Diversification

Consider diversifying your portfolio across multiple trading pairs rather than concentrating your risk on a single asset. This approach can help mitigate losses and enhance overall returns.

Common Mistakes to Avoid When Using Leverage

While leverage can be a powerful tool in trading, many traders make mistakes that can lead to significant losses. Here are some common pitfalls to avoid:

1. Overleveraging

One of the biggest mistakes traders make is using too much leverage. While higher leverage can amplify profits, it equally magnifies losses. Always ensure you are comfortable with the level of risk you are taking.

2. Neglecting Risk Management

Failing to employ proper risk management strategies can be detrimental. Be sure to use tools like stop-loss orders to protect your capital from unexpected market fluctuations.

3. Emotional Trading

Letting emotions dictate trading decisions is a common error. Stick to your trading plan and avoid making impulsive trades based on fear or greed.

Conclusion

Changing leverage on PrimeXBT is a fundamental aspect of trading that can significantly affect your outcomes. By understanding how to manage and adjust your leverage, you can make more informed trading decisions that align with your personal risk tolerance and market conditions. With careful consideration and strategic planning, you can harness the power of leverage to optimize your trading experience.

As with any trading strategy, continuous learning and adaptation to market changes are key. Monitor your performance, review your strategies regularly, and stay updated on market trends to enhance your trading journey on PrimeXBT.